HLG Wins 100k Coverage Dispute Against Surplus Lines Insurer

FACTS/BACKGROUND

On April 14, 2020, our 18-year-old client was rear ended by a Medium/Heavy Truck of more than 10,000 lbs with a trailer of 26,000 lbs. He was on I-75 driving home from work. Liability for the accident was contested as both drivers had conflicting statements of what happened. Our client claimed he was rear ended. The truck driver claimed our client swerved into his lane. The truck was operated by a motor vehicle carrier with a $1,000,000 insurance policy purchased from a surplus lines insurer. Surplus lines insurers are a specific type of insurance company that specialize in providing coverage for higher risk businesses. Unlike traditional insurance companies, they are not regulated by the Florida Office of Insurance Regulation.

ISSUE

RULE

An exclusion in a policy exists when the insurer does not have to pay for the actions of its insured due to the contract not covering a specific act. In other words, the agreement can create language that specifically says that insurer is not providing coverage in the event that the policy is not complied with. If an underlying policy is invalid there are still other potential methods of recovery for injured victims in a truck crash.

To protect members of the public, the Federal Government created the Federal Motor Carrier Act of 1980. The act mandated trucks that travel across state lines (interstate) carry $750,000 in supplemental coverage in the event that there is an exclusion on the policy.

Analysis

Next, Since the truck was driving inside the state of Florida, Florida rules would apply.

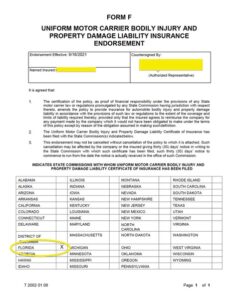

At the state level, the policy contained a Form-F endorsement that specified and checked a box which stated the policy would comply with the minimum financial responsibility laws of Florida. We argued, the Form F endorsement created an addition to the contract that provided coverage under FL Statute 627.7415 as discussed above. Since the vehicle weighed in the corresponding bracket of $100,000 in coverage we sent a demand letter requiring the full amount in compensation for our client.

The Surplus Insurer hired a third party claims administrator who informed us:

“We have completed our coverage investigation and have denied coverage to our insured. Neither the truck nor the trailer was listed on the policy at the time of the accident, neither the driver, named insured, nor owner qualify as insureds, and the driver was not conducting interstate transport. If you have any questions let us know.”

The insurance company either (1) was not informed of this information because the motor carrier did not want to pay a higher premium on the policy and never told them about the driver, or (2) the surplus insurer had neglected to fully investigate their insured and turned a blind eye to still receive financial compensation from the motor carrier in the form of premiums. Since Surplus lines carriers specialize in higher risk businesses, they often also charge and receive higher premiums in return for offering coverage. In fact, in a 2023 Markey segment report, AM Best credit rating agency reported that growth of surplus lines direct written premium in 2022 rose to a record $98.5billion, which is a jump of 19 percent.

Conclusion

The lawsuit increased the pressure on the insurance company because lawsuits can become very expensive and time consuming for both sides. The statute itself was also very clear that Form F required some type of supplemental insurance in a trucking accident like this one. Insurance companies also run the risk of bad faith if we obtained a larger verdict and a judge determined that coverage in fact existed. Eventually, after waiting for 30-days the insurance company after having coverage counsel review the merit of our claim, agreed to offer the full $100,000 we had originally requested.

Our client was thrilled that we obtained compensation when the other company had outright denied any type of responsibility for his accident. It is imperative that you utilize an attorney with the knowledge and expertise to make sure that other people do not tell you what you are entitled to under the law. Without a through understanding of truck coverage issues an attorney or individual would have been left with a recovery of zero dollars for their injuries.

Tom Harris, Florida Injury Attorney, has over 39 years of experience, including 17 years of defending insurance companies before reinventing his law practice to represent injured people as a personal injury attorney.

Kyle Harris is a Florida licensed attorney who joined the family practice after starting his career as a licensed attorney in California

Office Information

-

1226 Fruitville Road

Sarasota, FL 34236 - 941-366-0860

- 941-296-8688

- tom@harislawsrq.com